Guide for Buyers

Whether you are looking to purchase your first home, relocating, upsizing, downsizing or investing, we can help you find the property and support the entire buying process;

Our aim is to get rid of the jargon so we can have clear, transparent conversations, allowing you to make informed decisions swiftly and easily. We have put this guide together to help ease your property journey and our team are always on hand to help answer any questions you have and guide you along the way.

- Determine your Budget

Before you start looking at properties, you need to know how much you can spend. This means speaking with a Mortgage Advisor and discussing how much you can borrow. Buying a property is probably going to be one of the largest purchases you will ever make, so establishing exactly how much money you have to fund your purchase will save you time and avoid disappointment further down the line.

Your income, savings and how much you may get for selling your existing home (if applicable) should be taken into consideration. If you do have a property to sell, the first step is an up-to-date valuation, which Oulsnam can of course help with. Please get in touch with your local branch to make an appointment.

If you do not have a Mortgage Advisor, ask a member of our team and we can recommend an independent Mortgage Advisor who can help you with your finances.

- Register your details with us

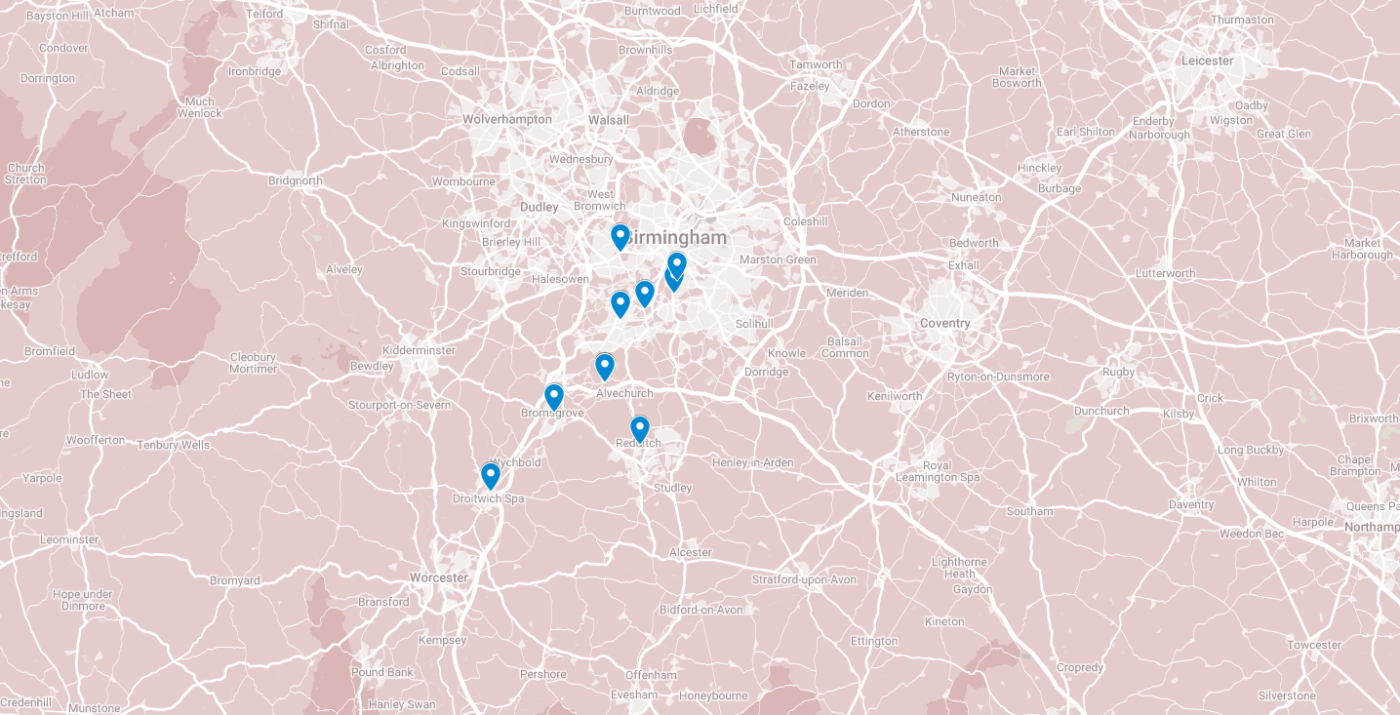

Property websites have made the process of finding a new home easier than ever. However, we recommend registering with an Oulsnam office, which you can do online or by dropping in to see us in one of our branches, where we can discuss your requirements for your next home with you. Once we have a clear understanding of your requirements, you will receive a selection of properties that match your criteria. We can also keep you up-to-date with the latest properties before they go online via our email alerts.